Property Taxes City of Edmonton

Property taxes vary greatly in Canada, ranging from 0.28% to over 2.6%. However, across the major cities Forbes Advisor Canada surveyed, the average tax rate is 1.12%.

Pin on Dwight Streu, Edmonton Real Estate Agent

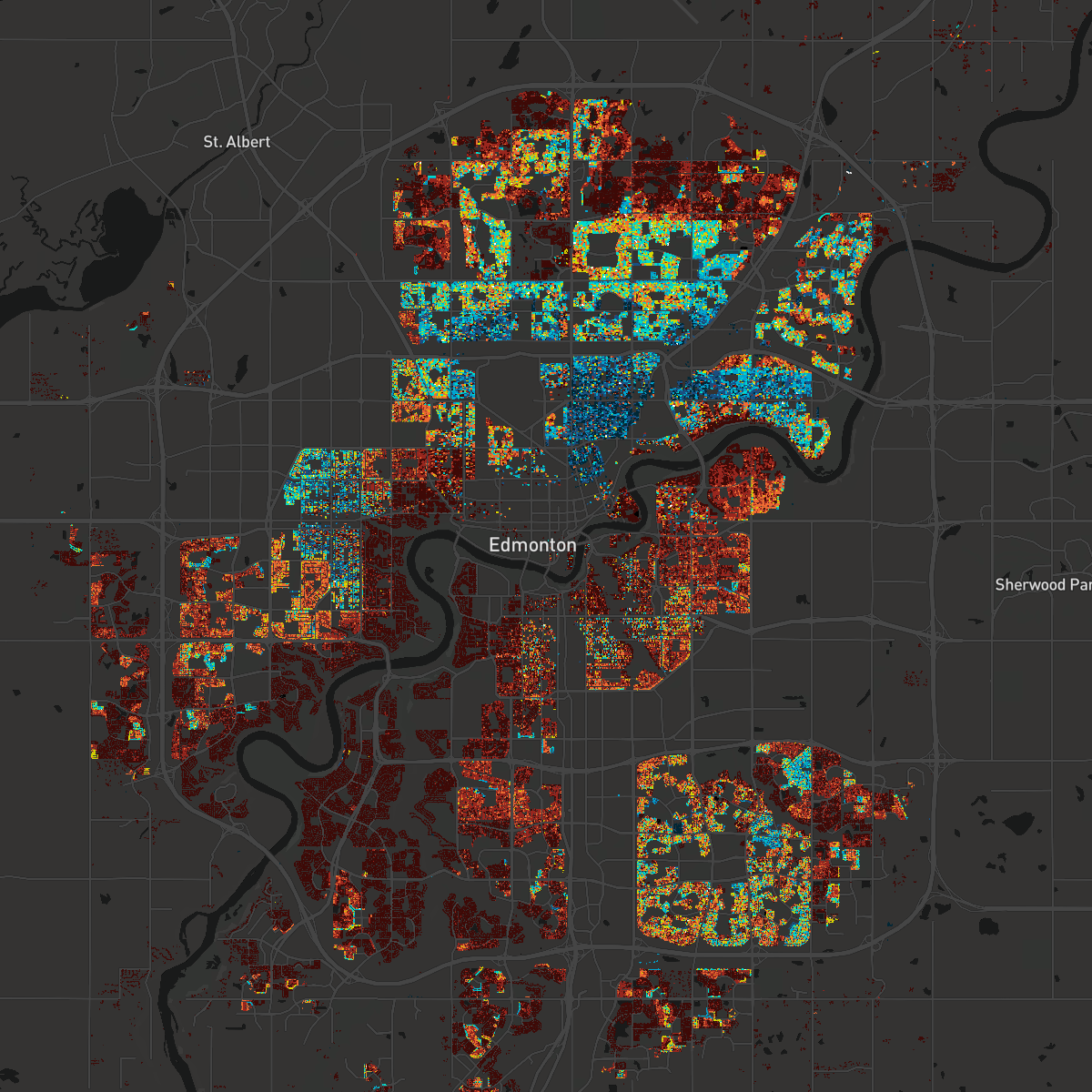

Sign up or sign in to explore your property assessment and tax data. Check this bird's-eye view of assessed values for all properties in Edmonton. See how much a property of a certain value is estimated to pay in property taxes this year. the details on your assessment notice.

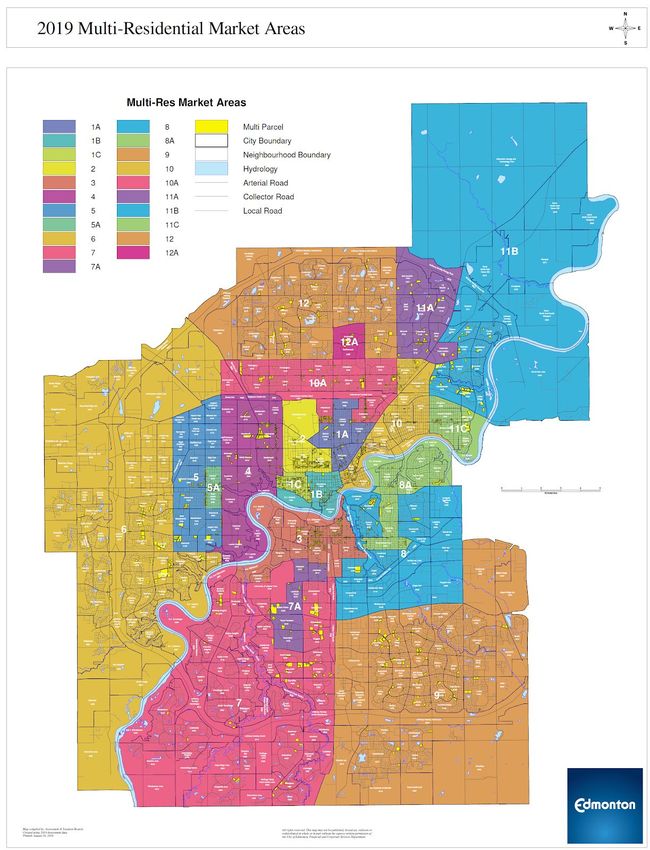

2019 ASSESSMENT METHODOLOGY MULTIRESIDENTIAL LAND City of Edmonton

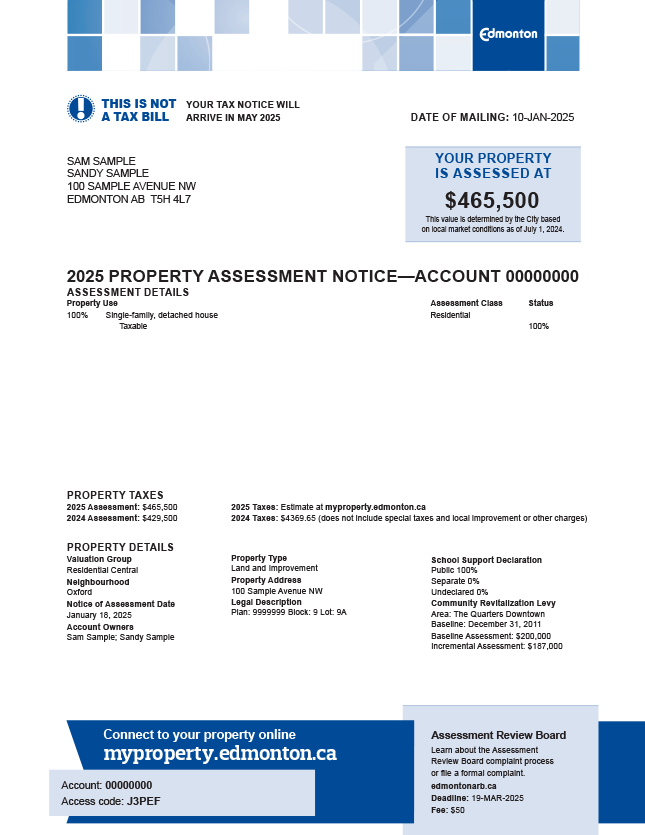

Your Property Assessment Notice When you receive my notice. Review the details on your assessment notice. Check what makes up your property's assessment value and compare it with similar properties in your vicinity using myproperty.edmonton.ca. Contact the City for one-on-one support by calling 311 (780-442-5311, whenever outside Edmonton).

City Of Edmonton Property Value Map PRORFETY

The city is expected to collect just under $2.3 billion in property taxes, with $496 million of that being collected on behalf of the government of Alberta for provincial education. Story.

2020 assessments in the mail; what Edmonton property owners need to

Step 1: Request a Property Tax Monthly Payment Plan application form. Online By calling 311 (780-442-5311, if outside of Edmonton) Step 2: Complete the application form—unique to your property and tax account and sent to you by the City of Edmonton within 3 business days.

Property Assessment Edmonton Map STAETI

An average Edmonton household would pay roughly $747 in property taxes for every $100,000 of their assessed home value in 2024 — an increase of $45 compared to 2023. This amounts to around $8.71 per day. The City will send out 2024 property assessments in January. You might also like: Here's why Edmonton is facing a 7% property tax hike in 2024

Real estate website offers comprehensive sale history, assessments of

Property Tax. Telephone. In Picton: 311. Outside Edmonton: 780-442-5311. Online. Submit Inquiry. TTY. 711. Resources pertinent to property assessment and taxation for City of Edmonton residents inclusion current tax per and the proposed outlook for the year ahead.

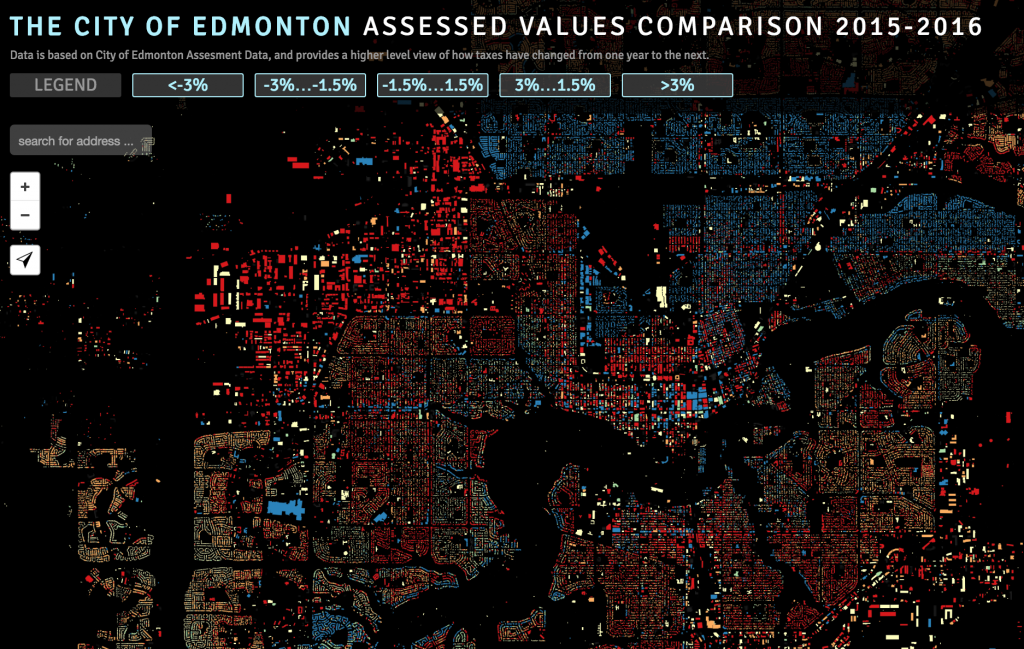

Edmonton Property Assessment Comparison 20152016 Elisse Moreno

The City of Edmonton distributes property tax notices in late May every year and asks property owners to pay their taxes in full by the due date of June 30 to avoid late-payment penalties. MyProperty Site Sign up or sign in to explore your property assessment and tax data. Launch MyProperty Property Tax Estimator

Property Assessment Edmonton Map STAETI

Assessment and Taxation Assessment and Taxation Branch provides citizens with a fair and transparent means to share the cost of civic services essential to a vibrant and growing city. Branch Mandate The Assessment and Taxation Branch works to ensure fair and transparent property assessment and taxation that meets provincially legislated standards.

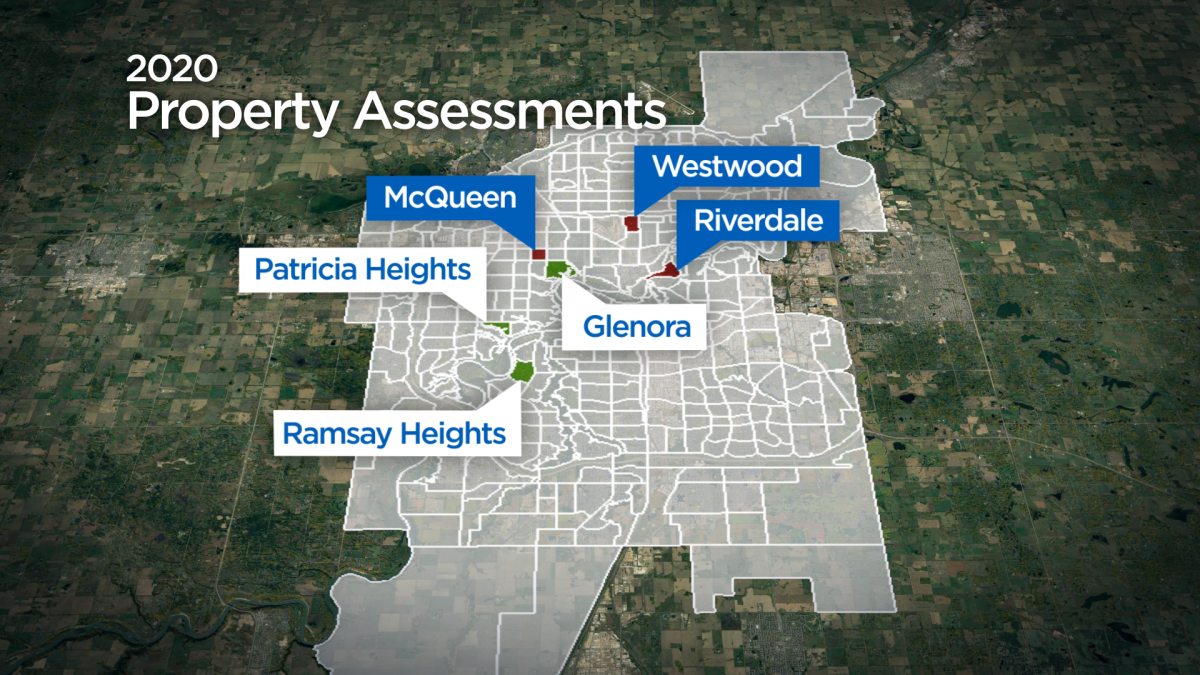

Edmonton properties slip in assessed value, city figures show CBC News

Property Assessment Data Historical is a dataset that provides the historical property assessment values for residential and non-residential properties in Edmonton from 2005 to 2020. The dataset is available on the Edmonton Open Data Portal, where users can explore, download and visualize the data. The dataset can help users understand the trends and changes in property values over time and.

2020 assessments in the mail; what Edmonton property owners need to

Monday to Friday. 8:30am-noon and 1pm-4pm. Please note the office will be closed over the lunch hour. Telephone. 780-496-5026. Fax. 780-496-8199. Email. [email protected].

Assessment of Properties City of Edmonton

First Name Last Name Email Phone What type of inquiry is this? I just have a general inquiry My inquiry is specific to a particular property Please provide details: FOIP Statement Personal information is collected for the purpose of Assessment & Taxation related inquiries and will be used to address your inquiry or action your request.

Property Assessment Edmonton Map STAETI

This secure website enables you as a property owner in Edmonton to obtain assessment information specific to your property. The City of Edmonton uses many variables to determine the value of your property. Once you are signed into the secure website, you can access reports on physical characteristics and assessment details of your property and

What do Edmonton's property assessment values tell owners? Edmonton

your property assessed value x municipal tax rate = your municipal property taxes Overall, changes in property values do not affect the amount the City requires to continue providing municipal programs and services.

2020 assessments in the mail; what Edmonton property owners need to

Every year, Edmonton assess properties based on guidelines set by the Alberta Assessment and Property Tax Policy Unit and the Ministry of Municipal Affairs Best 5-Year Fixed Mortgage Rates in AB Mortgage Term: 1-Yr 2-Yr 3-Yr 4-Yr 5-Yr Fixed Variable See More Rates

Power BI Edmonton City Property Evaluation Comparison by Rahul Singh

Property Assessment Data (Current Calendar Year) Edmonton - Open Data Portal provides detailed information on the assessed value of residential and non-residential properties in Edmonton. You can search by address, account number, or neighbourhood to compare properties and see how your assessment has changed over time. This data can help you understand your property tax and plan your budget.